Single-use plastics are a plague on Canada’s legal cannabis industry and we should be ashamed.

Since 2018 legal weed in Canada has been a source of pride and prejudice for consumers and non-consumers alike. While there is much to love about legal weed in Canada, there is no question that there is room for improvement in the industry.

In the early days of legalization, solid black plastic packaging dominated the market, with many brands opting to package their product in sleek-looking but unrecyclable containers.

These jars are widely used and decompose slowly over decades, pumping toxins into the soil and eventually making their way to the closest ocean. The exact scope of the rec market’s plastic waste problem is hard to quantify. Overall the impact has been decidedly negative.

In 2019, the environmental company [Re]Waste estimated that between 5.8 and 6.4 million kilograms (or between 12.7 million and 14.1 million pounds) of plastic from cannabis packaging ended up in landfills between October 2018 and August 2019,

And cannabis sales and the range of available products have only increased since then.

A widely circulated CBC report, published only five days after legalization came into effect, found that for each gram of cannabis that was legally sold, as much as 70 grams of plastic waste was generated.

Blaming the regulations is tired, but they definitely don’t help

Cannabis packages must be opaque or translucent, child-resistant, include a security seal, and be large enough to accommodate a label that includes a significant amount of information. This includes a large warning label in both English and French. All with minimum font sizes.

All of these directives contribute to increasing the amount of plastic that goes into the containers. This limits packaging options for producers and pushes companies toward using low-cost plastic containers.

Some companies, like Divvy, minimize their plastic use with tin and removable parts.

Health Canada has argued that they don’t force these companies to use the cheapest option. Officially the organization “encourages the use of innovative and environmentally sound packaging approaches, provided the requirements in the regulations are satisfied.”

Polypropylene plastic, a thermoplastic “addition polymer” manufactured by combining multiple propylene monomers, became an obvious choice for the industry from the outset.

It’s light, sturdy, and recyclable. All the things cannabis producers look for in their weed containers.

Myrna Gillis, CEO of Nova Scotia-based craft producer Aqualitas, notes that fear of running afoul of Health Canada’s stringent packaging regs is a motivating factor in maintaining the current, waste-generating status quo.

“They really don’t turn their mind to that at all,” Gillis explains. “They leave those decisions to the producers to make, but if you don’t do it in a way that’s compliant, then there are consequences.”

Health Canada takes the position that its role is to craft regulations with regards to public health, as opposed to environmental impact; sustainable packaging falls outside its purview.

A McGill University 2020 study of the industry’s plastic waste found that “cannabis regulations—grounded in concern for public health and public safety—have led producers to package products in larger and more resource-intensive containers than necessary.” The study’s lead author, Omar Akeileh, is now the director of partnerships and sustainability at the Cannabis Council of Canada.

As a further complication, Health Canada also heavily restricts cannabis advertising– gagging companies who are packaging more sustainably from promoting their position and preventing waste-conscious consumers from making informed choices.

“With no way to communicate to customers whether their packaging is environmentally-friendly, some producers may find it difficult to justify moving away from inexpensive virgin plastic,” the study states. “Taken together, cannabis producers are risk-averse and have few incentives to explore innovative packaging solutions.”

Producers are leading sustainability efforts

Despite restrictive regulations, efforts to improve cannabis packaging are underway. Both large- and small-scale producers have been working to reduce the impact of plastics.

Execs at Nova Scotia’s Aqualitas knew cannabis packaging was a problem but found initially found themselves at an impasse as to how to reduce their packaging-related carbon footprint. Even just navigating the bureaucracy around getting their licence had proved challenging; figuring out how to improve their packaging from the plastic options available was an additional quandary.

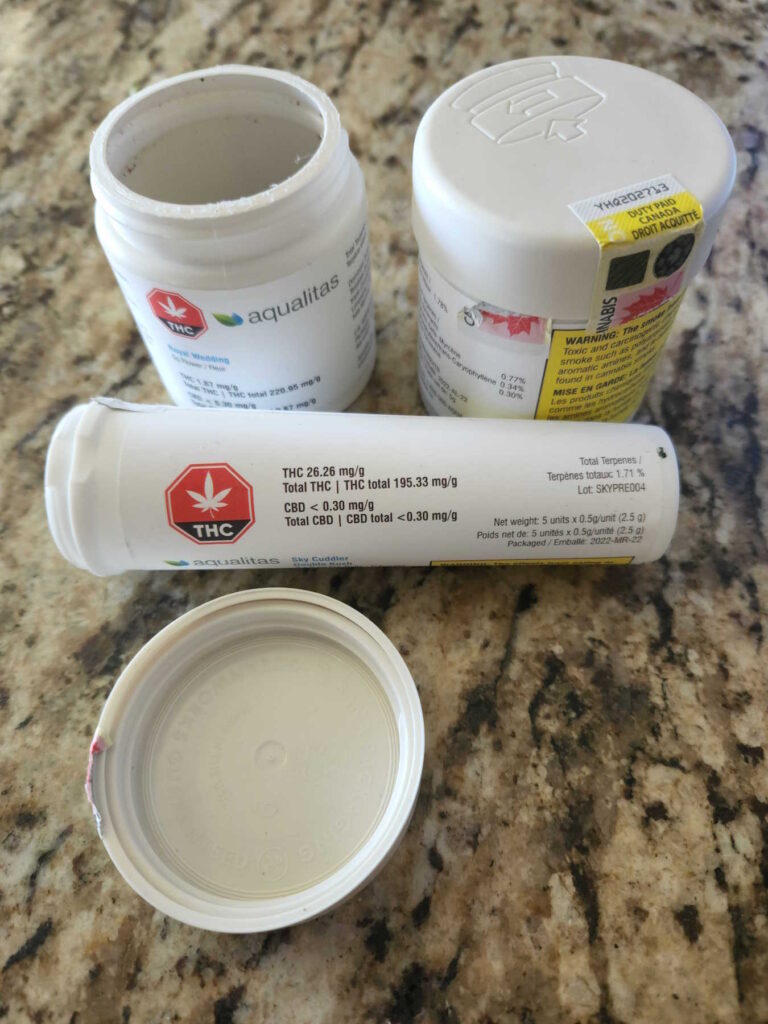

The company used locally-sourced containers for their products, but “there weren’t many alternatives,” Gillis says. So Aqualitas teamed up with US-based supplier Sana Packaging to develop packaging made from reclaimed, ocean-sourced plastics.

“We wanted to be going into this kind of packaging when we started our company, but we couldn’t find any alternatives,” Gillis says. “The licensing process with Health Canada was extremely time-consuming, so there was a lot of trying not to create a new wheel, so to speak.”

Aqualitas has teamed up with Sana Packaging to produce their containers from reclaimed ocean plastics.

But the wheel did indeed require a degree of reinvention

“It’s been two years in the making to source raw materials, connect with a manufacturer, get the product certified, conduct product impact investigations, and make it work during a pandemic,” Aqualitas director of operations Josh Adler commented when the producer introduced the new packaging in early 2021.

Other producers have found their own solutions. 48North now uses biodegradable cardboard packaging to house their pre-rolls, which are rolled with unbleached papers. The company’s dried flower bags, which often cannot be recycled because of their foil linings, are instead made of cardboard-like materials, drastically reducing the amount of plastic involved.

Other producers are also making efforts to improve their packaging.

When LP giant Auxly launched their Kolab line of vape cartridges, they came in biodegradable boxes. Mood Ring packages their flower in recyclable aluminum tins and their pre-rolls in compostable doob tubes.

Despite support for sustainability in cannabis, many brands still use plastics and mylar bags like this one.

Canopy Growth still uses black mylar plastic bags for dried flower products, which persist as an industry standard.

“The bags we have are not recyclable as of today,” admits Caton, “but they are less plastic, and less weight, and all those kinds of things…We like the bags, they are less onerous on the environment overall, and the cannabis maintains the quality attributes we’re looking for.”

Canopy’s approach illustrates what large-scale producers grapple with when it comes to packaging. But when it comes to core flower products changes have been sluggish at best.

One radical idea? Permit bulk sales: consumers bring a jar to the dispensary, and budtenders weigh out the buyer’s desired amount.

What looks possible for the future

A suggestion more likely to pass regulatory muster in the short term involves removing the requirement for child-resistant packages. For all products without active THC in them,. Including CBD products and flower. These products contain only inactive THC and are non-intoxicating. This measure seems more likely to appease both industry players and regulators alike.

Many want to be able to promote the work they have done on their own packaging. This would create an incentive for consumers to gravitate toward sustainable packaging.

Ultimately the bulk of the responsibility for developing and implementing more sustainable packaging solutions lies with the industry.

Those decisions are long overdue.